By shopping for an index fund, you may kind of shape the market return quite simply. But in case you select the right person stocks, you can make more than that. Just take a look at RIB Software SE (FRA: RIB), that’s up to eighty-one % over three years, soundly beating the marketplace return of 9.6% (now not together with dividends).

View our latest evaluation for RIB Software.

While markets are a powerful pricing mechanism, proportion charges reflect investor sentiment, not just the underlying overall business performance. By evaluating profits in step with earnings per share (EPS) and percentage charge changes over time, we will get a feel for how investor attitudes to an organization have morphed over the years.

During three years of proportional price increase, RIB Software completed compound profits in line with the share growth of 21% consistent with the year. Notably, the 22% common annual share rate benefit matches up properly with the EPS increase in the fee. This observation suggests that the market’s attitude to the business hasn’t changed a good deal. Quite to the contrary, the proportion rate has arguably hindered the EPS increase.

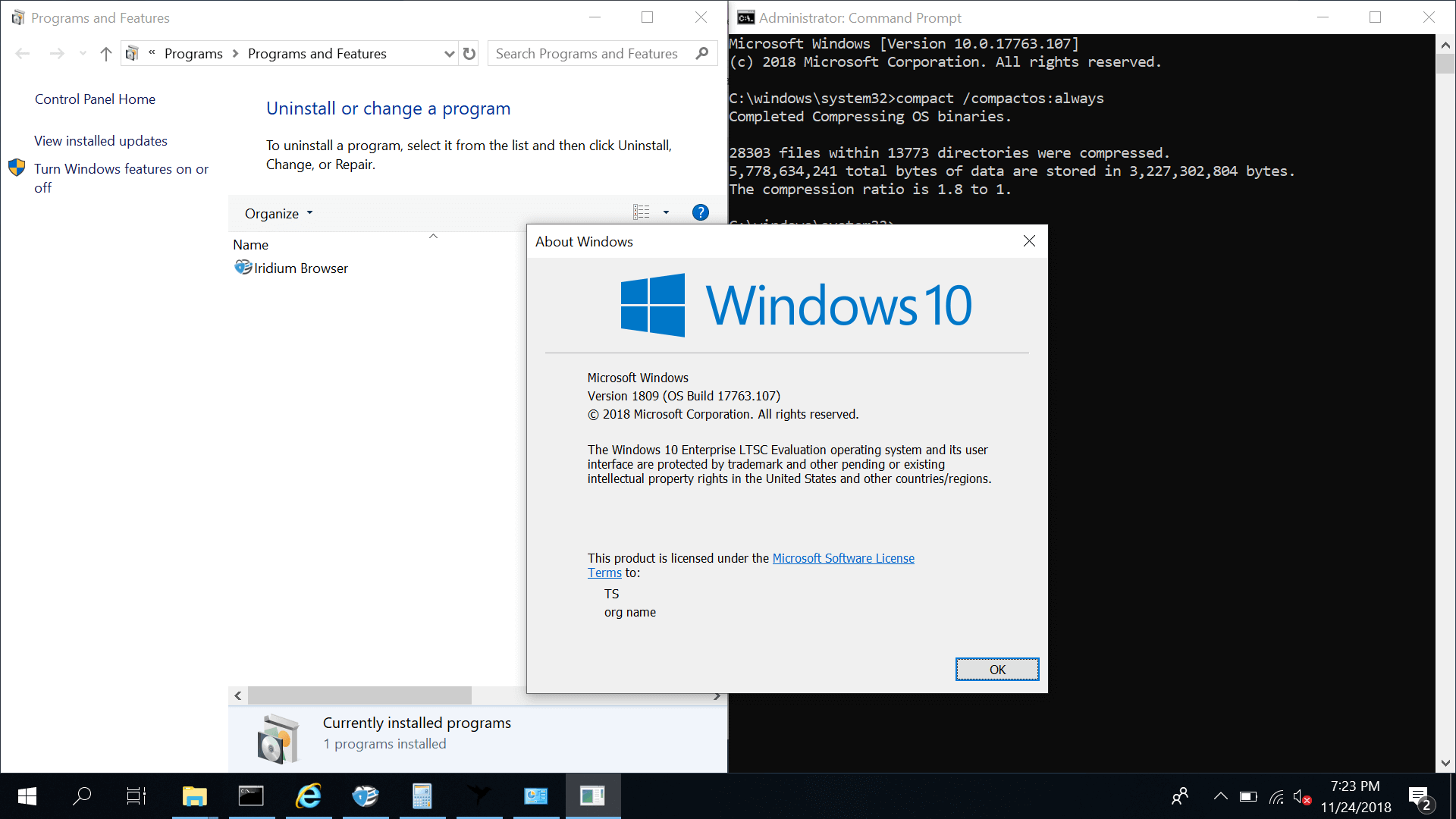

The photograph underneath shows how EPS has tracked over time (if you click on the photo, you may see a greater element). It is probably profitable to study our free report on RIB Software’s profits, revenue, and cash flow.

What About Dividends?

It is vital to consider the whole shareholder return, in addition to the proportion of return for any given stock. The TSR consists of the fee of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for businesses that pay a generous dividend, the TSR is usually a lot better than the percentage return. As it occurs, RIB Software’s TSR for the final three years was 88%, which exceeds the percentage rate return noted in advance. The dividends paid by the organization have thus boosted the entire shareholder return.

A Different Perspective

While the broader market lost approximately three.6% inside the twelve months, RIB Software shareholders did even worse, losing 27% (including dividends). Having stated that, a few stocks could inevitably be oversold in a falling market. The secret’s to maintain your eyes on the fundamental tendencies. On the bright side, long-term shareholders have made cash, with a gain of 10% per 12 months over half a decade. If the essential information continues to suggest a long-term sustainable increase, the modern sell-off could be an opportunity well worth thinking about. Before deciding if you like the present-day proportion rate, look at how RIB Software scores on those 3 valuation metrics.

If you choose to test out another organization — one with potentially advanced financials — then do not leave out this free listing of organizations that have proven they can grow income. Please be aware that the market returns quoted in this text mirror the market-weighted common returns of stocks that presently trade on DE exchanges.

We intend to bring you a long-term research evaluation based on tonessential data. Note that our analysis won’t change aspects in the trendy rate-touchy organization announcements or qualitative cloth.

If you notice a mistake that warrants correction, don’t hesitate to contact the editor at editorial-team@simplywallst.Com. This article, through Simply Wall S, is wellknown in nature. It does not constitute a recommendation to shop for or promote any inventory and does not take into account your goals or your financial state of affairs. Simply Wall St has no role within the stocks cited. Thank you for reading.